User Guide - Refunds

This guide is an overview of the functionality and process for issuing refunds to homeowners in Smartwebs.

Overview

The use of refunds allows the user to issue a check to a homeowner for an overpayment or credit balance on their account.

Please note, this is currently not an option for past owners.

The refund process does not create a vendor record for the homeowner, which helps to keep vendor lists lower.

Note: This is not the same as a reimbursement (paying back a Homeowner/Board Member for an association expense).

When processed in Smartwebs Accounting, refunds do not create vendors in the system but are treated in every other way as a regular payable (i.e. on reports, recognized as liabilities, etc.)

Example: A homeowner overpays their annual assessments and rather than carrying a credit balance for a year, opts to receive a refund.

To add a “Refund,” the payee must be a current owner in the system and the payable must be processed in Smartwebs Accounting (not an integrating partner. (i.e. Avid/Strongroom)).

** If the user is using the Avid/Strongroom integration, and wants to process the invoice through Avid/Strongroom, a separate vendor must be created.

Creating a Refund

- Navigate to Accounting > Receivables > Homeowners

- Locate the homeowner with a credit balance.

- From the "Options" dropdown menus, select "Issue Refund"

- Type - From the dropdown, Select the payment type: Check or Cash

- Pay From - From the dropdown, Select the bank account (if different from the default)

- Ref #: - Optional

- Cost Center - From the dropdown, Select the Cost Center (if different from the default)

- Memo - Optional

- Payment Date - This will default with today's date, make changes if needed

- Refund Amount - Here you can enter the full Credit/AR balance or a portion of that Credit/AR balance

- Once all required fields are completed, you will select the blue "Create" button.

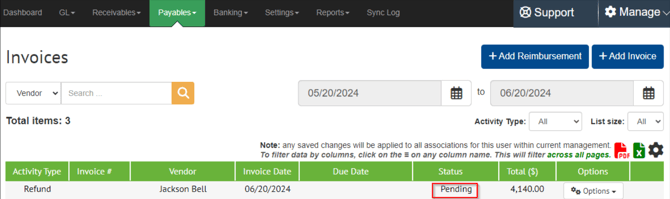

You have now created an Invoice with a Pending status. You can see this here : Accounting > Payables > Invoices

Printing the Check

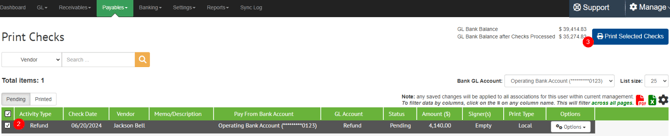

- Navigate to: Accounting > Payables > Checks

- Check the box in row for the check you want to print, or select all from the header

- Select the blue "Print Selected Checks" button

- In the Pop-up, confirm the starting check number and check position, then select the blue "Print" button

- There will be a Pop-Up giving you options to:

- View in a new tab - This opens a new window with the check image

- Download - Allows you to name, then save a copy of the PDF

- Email - Sends the PDF via email

- Post - Allows you to save the PDF to a document folder within the association documents

- For this example we will use the "View in a new tab" option. Select the blue "Open" button

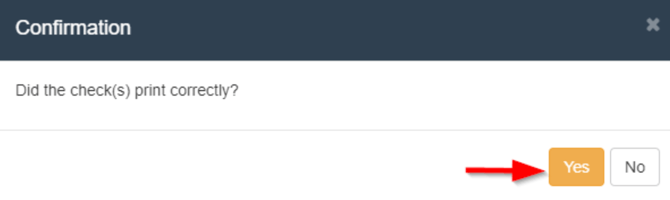

- A confirmation Pop-Up will ask if the checks printed correctly; Select the orange " Yes" button to confirm

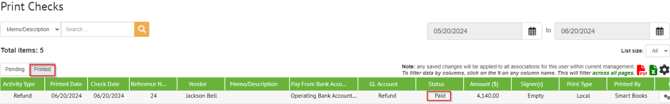

- The check will now show in the "Printed" tab instead of the "Pending" tab and will have a status of "Paid"

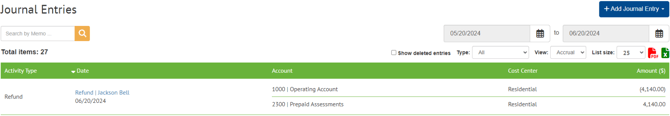

- The Payment Journal Entry is now created. To view the Journal Entry: Navigate to Accounting > GL > Journal Entries. Here you will see the entry to debit the default Accounts Payable GL and credit the bank account GL

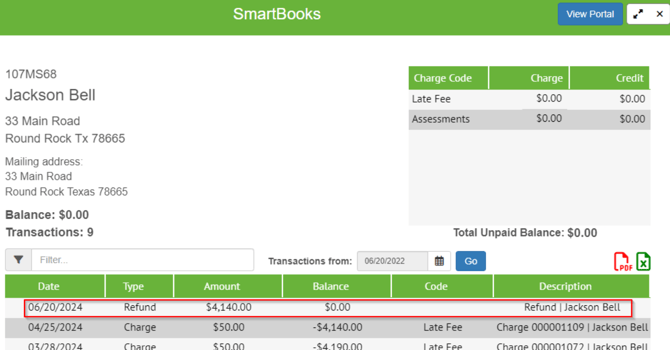

- The homeowner ledger will now reflect the refund

Refunds for Past Owners

Past owners cannot use the Refunds process, so you will need to add a charge to the account for the amount of the refund then create a traditional vendor payment. You will use the revenue GL that is associated to the charge code you used as the expense GL for the payment.